Auto insurance rates have been steadily climbing in recent years, leaving many drivers wondering why their premiums are increasing. Several factors contribute to this trend, ranging from economic shifts to changes in driving patterns and the growing complexity of claims.

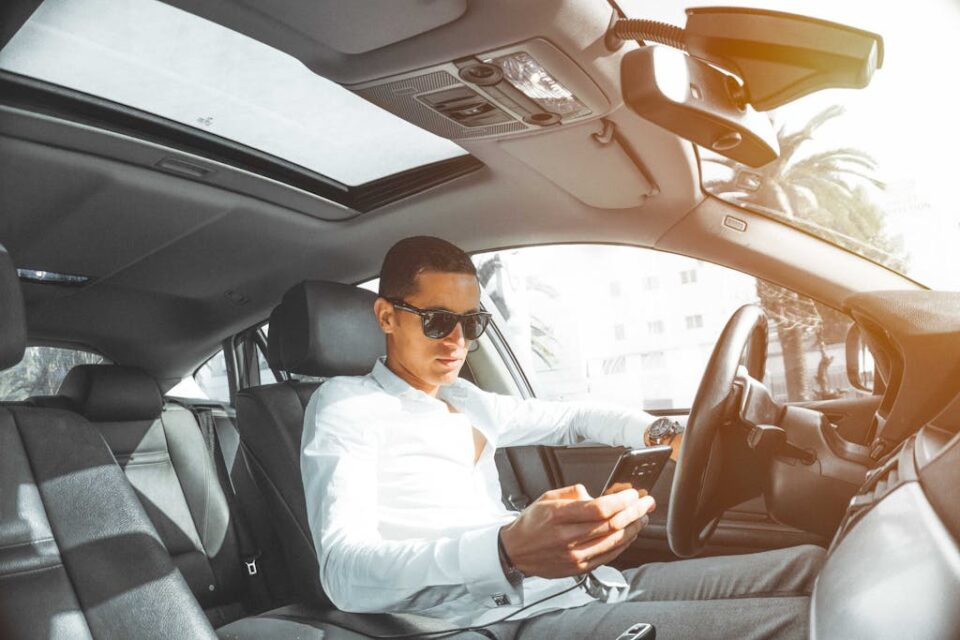

Increased Accident Frequency

Despite advancements in vehicle safety technology, the frequency of accidents has risen in recent years. Distracted driving, often caused by smartphone use, is a major contributor. More accidents lead to more claims, which in turn drives up insurance costs for everyone.

Higher Repair Costs

Modern vehicles are equipped with advanced technology, such as sensors, cameras, and automated systems, which can be expensive to repair or replace. While these features improve safety, they also increase the cost of claims. Insurers must account for these higher expenses when setting premiums.

Rising Medical Costs

The cost of medical care has been steadily increasing, impacting the payouts for injury claims. When drivers or passengers are injured in an accident, insurers must cover medical expenses, which can significantly affect overall claim costs and lead to higher premiums.

Inflation and Economic Factors

Economic inflation has a direct impact on the cost of auto insurance. As the prices of vehicle parts, labor, and healthcare rise, insurers must adjust their rates to remain financially viable. Additionally, supply chain disruptions have led to delays and increased costs for vehicle repairs, further contributing to higher premiums.

Climate-Related Risks

Extreme weather events, such as hurricanes, floods, and wildfires, are becoming more frequent and severe. These events often result in a surge of claims for vehicle damage, prompting insurers to increase premiums to cover the growing risk.

Legal and Regulatory Changes

Changes in state laws and regulations can also influence insurance rates. For example, stricter minimum coverage requirements or increased penalties for uninsured drivers may lead to higher premiums for policyholders.

Auto insurance rates are influenced by a complex interplay of factors, many of which are beyond the control of individual drivers. Understanding these underlying causes can help consumers make informed decisions when selecting coverage and exploring ways to manage their insurance costs.